|

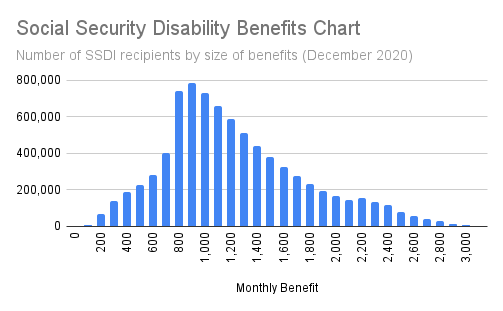

Your SSDI payment depends on your average lifetime earnings. Here’s how to find out how much you could get in 2022, and how other sources of income come into play.. Estimating Your Social Security Disability Amount. Calculating Your Monthly SSDI Payment. How Do I Find Out My Social Security Benefit Amount?. Other Income That Could Reduce Your SSDI Payment. Changes to Your SSDI Amount. Social Security Backpay. . Your SSDI payment depends on your average lifetime earnings. Here’s how to find out how Show

Top 1: How Much in Social Security Disability Benefits Can You Get?Author: disabilitysecrets.com - 114 Rating

Description: Your SSDI payment depends on your average lifetime earnings. Here’s how to find out how much you could get in 2022, and how other sources of income come into play.. Estimating Your Social Security Disability Amount. Calculating Your Monthly SSDI Payment. How Do I Find Out My Social Security Benefit Amount?. Other Income That Could Reduce Your SSDI Payment. Changes to Your SSDI Amount. Social Security Backpay Your SSDI payment depends on your average lifetime earnings. Here’s how to find out how

Matching search results: WebDec 13, 2022 · Because benefit amounts depend on lifetime earnings, there's a large range in how much Social Security pays. For instance, let's look at age 55, the most common age disabilities start. For 55-year-olds who have worked their entire lives, Social Security typically pays $1,000 to $2,700. The benefits pay chart here shows you the ranges based … ...

Top 2: Social Security benefits to go up by more than $140 per month in …Author: cnbc.com - 173 Rating

Description: Xavierarnau | E+ | Getty ImagesSocial Security benefits will go up by more than $140 per month on average in 2023, as a record 8.7% cost-of-living adjustment kicks in.Exactly how much of an increase the approximately 70 million Americans who rely on the program for. income will see will vary.More than 65 million Social Security beneficiaries will see their benefit checks increase in January, while more than 7 million Supplemental Security Income beneficiaries will see bigger payments starting on

Matching search results: WebOct 21, 2022 · To find out exactly how much you stand to receive sooner, you can calculate the change on your own: Multiply your net Social Security benefit by 8.7%, the 2023 cost-of-living adjustment. ...

Top 3: Here's How Much Your Social Security Shrinks if You File EarlyAuthor: fool.com - 160 Rating

Description: What does it mean to file early?. What does it mean for your benefit to shrink?. This is how much your monthly benefit will shrink if you file early. How is this reduction in monthly benefits determined?. But will your lifetime benefits be lower?. Calculating your break-even point if you don't file early. Waiting until after FRA could boost your benefit further. There's another way your benefits could shrink if you file ASAP. Now you understand how much your Social Security shrinks if you file early.

Matching search results: WebOct 24, 2019 · Social Security retirement benefits provide a lifelong source of income that goes up along with inflation.Half of married seniors and around 70% of unmarried elderly persons rely on Social ... ...

Top 4: Social Security benefits will increase in 2023. Here's what to know.Author: usatoday.com - 160 Rating

Description: What is Social Security?. How to apply. for Social Security. How much Social Security will I get?. Is. Social Security taxable?. How to get a new Social Security card?. Why did I get two Social Security checks this month?. How to apply for disability Social Security recipients will get a hefty raise in 2023, with benefits rising 8.7%, the most in four decades.The inflation-related bump may coax some retirees into tapping their benefits early, before they reach full retirement age. It also ma

Matching search results: WebNov 23, 2022 · Social Security recipients will get a hefty raise in 2023, with benefits rising 8.7%, the most in four decades.. The inflation-related bump may coax some retirees into tapping their benefits early ... ...

Top 5: Your Social Security Check Is Getting a Big Increase in January.Author: cnet.com - 179 Rating

Description: How much will Social Security benefits increase in 2023? . When will I see the increase in my Social Security check? We're just a few days away from the start of 2023, when retirees and others who receive Social Security will see a healthy increase in their benefits: Monthly checks are increasing by 8.7%, based on a cost-of-living adjustment, or COLA, announced in October. That's the largest hike since the all-time. record of 11.2%, set back in 1981."A COLA of 8.7% is extremely rare and would

Matching search results: WebDec 23, 2022 · How much will Social Security benefits increase in 2023? The 2023 COLA is 8.7% . Here's how that breaks down for different groups, according to the Social Security Administration (PDF). ...

Top 6: How do I sign up for Medicare? | MedicareAuthor: medicare.gov - 136 Rating

Description: Do you get benefits from Social Security (or the Railroad Retirement Board) now?. Do you get benefits from Social Security (or the Railroad Retirement Board) because of a disability or ALS (also called Lou Gehrig's disease)?. Do you have ALS (Amyotrophic Lateral Sclerosis, also called Lou Gehrig's disease)?. Did you start getting benefits from Social Security (or the Railroad Retirement Board) at least 4 months before you turned 65?. Select. which best describes you:. Do you plan to start getting benefits from Social Security (or the Railroad Retirement Board) at least 4 months before you turn 65?. Select your situation:. You. automatically get Medicare.

Matching search results: WebJan 1, 2022 · Online (at Social Security) – It’s the easiest and fastest way to sign up and get any financial help you may need. (You’ll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.) Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. Contact your local Social Security office. ...

Top 7: How much you'll get in Social Security - The US SunAuthor: the-sun.com - 125 Rating

Description: How much you'll get in Social Security. We pay for your stories! IF you're expecting to mainly live on Social Security benefits in retirement, it's especially important to know how much you'll get.Social Security payments are based on your salary during your working career, at what age you claim and how long you've worked for.1We explain how much you'll get in Social Security in retirement depending on your salaryCredit: Getty. In 2022, the maximum monthly payment will be $4,194, while the avera

Matching search results: WebNov 26, 2021 · We explain how much you'll get in Social Security in retirement depending on your salary Credit: Getty. In 2022, the maximum monthly payment will be $4,194, while the average benefit will sit at a lower to $1,657.. To help you know how much you can expect, we've calculated monthly benefits based on a number of circumstances. ...

Top 8: How Much Do I Need to Retire Comfortably? | The Motley FoolAuthor: fool.com - 110 Rating

Description: It's not about money, it's about income. So how much income do you need?. Social Security, pensions, and other reliable income sources. How much savings will you need to retire?. Related retirement topics. The bottom line on retirement savings goals How much money do you need to comfortably retire? $1 million? $2 million? More?Financial planners often recommend replacing about 80% of your pre-retirement income to sustain the same lifestyle after you retire. This means that, if you earn $100,000

Matching search results: WebSep 20, 2022 · Social Security, pensions, and other reliable income sources. The good news is that, if you're like most people, you'll get some help from sources other than your savings, such as your Social ... ...

Top 9: Social Security Calculator: Estimate Your Benefits - AARPAuthor: aarp.org - 129 Rating

Description: What does AARP’s Social Security Calculator do?. How does the calculator estimate my retirement benefits payment?. Who is eligible to collect Social Security retirement benefits?. How is Social Security funded?. When should I start collecting Social Security?. Can I use the calculator to figure out Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)? All the information presented is for educational and resource purposes only. It is not intended to provide specifi

Matching search results: WebDec 16, 2022 · If she has $3,000 a month in expenses, her Social Security check would cover 46 percent of them if she started Social Security at age 62. If she waited till age 70, her check would cover 82 percent of her expenses. Every year she delays retirement, her Social Security payout — which is adjusted annually for inflation — rises by about $1,604. ...

Top 10: How Much Money Does a Child Get From Social Security When Both ... - ChronAuthor: work.chron.com - 153 Rating

Description: Eligibility for Benefits. Special Lump Sum Benefit. Earnings and Reductions If you are caring for a child who has lost both parents, you may be able to help your ward to apply for benefits under the Social Security program if at least one of her parents contributed to Social Security. This applies whether the child was adopted, a biological child or a stepchild living in the deceased's home.Eligibility for BenefitsTo qualify for benefits, the child must be unmarried and under 18 years of age, o

Matching search results: WebNov 19, 2020 · Subject to certain conditions, a child who loses both parents also may be able to receive the Social Security special lump sum death payment of $255 that normally goes to a surviving spouse.The child must have been receiving benefits based on the parent's earnings record, or must have been eligible for such benefits at the time of death. ...

Top 11: Social Security Quick CalculatorAuthor: ssa.gov - 67 Rating

Description: Benefit CalculatorsFrequently Asked Questions. Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption about your past earnings, you will have the. opportunity to change the assumed earnings (click on "See the

Matching search results: For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit ...For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit ... ...

Top 12: Benefit Calculators - SSAAuthor: ssa.gov - 66 Rating

Description: Benefit Calculators (En español). Online Benefits Calculator. Additional Online Tools Benefit Calculators (En español)The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings,. get your Social Security Statement, and much more – all from the comfort of your home or office.We have a variety of calculators to help you plan for the future or to assist you with your needs now.Online Benefits CalculatorT

Matching search results: Provides a listing of the calculators you can use to figure your retirement, disability and survivors benefits.Provides a listing of the calculators you can use to figure your retirement, disability and survivors benefits. ...

Top 13: Social Security Benefit AmountsAuthor: ssa.gov - 74 Rating

Description: Summary Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount (PIA). The PIA is the basis for the benefits that are paid to an individual.The formula used to compute the PIA reflects changes in general wage levels,. as measured by the national average wage index. We have constructed examples to illustrate how retireme

Matching search results: Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings.Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. ...

Top 14: How Much Will I Get From Social Security? - AARPAuthor: aarp.org - 154 Rating

Description: Your retirement benefit is based on your lifetime earnings in work in which you paid Social Security taxes. Higher income translates to a bigger benefit (up to a point — more on that below). The amount you are entitled to is modified by other factors, most crucially the age at which you claim benefits. For reference, the average Social Security retirement. benefit in 2023 is an estimated $1,827 a month. The maximum benefit — the most an individual retiree can get — is&nbs

Matching search results: The maximum benefit — the most an individual retiree can get — is $3,627 a month for someone who files for Social Security in 2023 at full retirement age (FRA), ...The maximum benefit — the most an individual retiree can get — is $3,627 a month for someone who files for Social Security in 2023 at full retirement age (FRA), ... ...

Top 15: Social Security Calculator | Benefits Estimator - BankrateAuthor: bankrate.com - 130 Rating

Description: How we make money Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. Bankrate, LLC NMLS ID# 1427381 |. NMLS Consumer Access BR Tech Services, Inc. NMLS ID #1743443 | NMLS C

Matching search results: If you start collecting your benefits at age 65 you could receive approximately $33,773 per year or $2,814 per month. This is 44.7% of your final year's income ...If you start collecting your benefits at age 65 you could receive approximately $33,773 per year or $2,814 per month. This is 44.7% of your final year's income ... ...

Top 16: Social Security Calculator (2022 Update) - Estimate Your BenefitsAuthor: smartasset.com - 125 Rating

Description: Calculate My Social Security Income. Who Is Eligible for Social Security Benefits?. How Does the Social Security Administration Calculate Benefits?. Is There a Maximum Benefit?. What If I Continue Working in My 60s?. Are Social Security Benefits Taxable? Calculate My Social Security IncomePhoto credit: © iStock/ZinkevychThese days there’s a lot of doom and gloom about Social Security’s solvency - or lack thereof. And regardless of whether you think Social Security’s future is secure, the fact r

Matching search results: Dec 22, 2022 · Understanding your Social Security benefits is an important part of ... Use SmartAsset's calculator to determine what your benefits will be.Dec 22, 2022 · Understanding your Social Security benefits is an important part of ... Use SmartAsset's calculator to determine what your benefits will be. ...

Top 17: How Much Social Security Will I Get in Retirement? - ExperianAuthor: experian.com - 155 Rating

Description: How Are Social Security Payments Calculated?. 3 Ways to Estimate Your Social Security Benefits. Adjustments for Inflation. 1. Get a Quick Estimate Using the Social Security Benefits. Calculator. 2. Download your Social Security Statement for a Detailed Summary. 3. Visit Your Account Page for Interactive Help Social Security benefits can be a stable source of monthly income when you retire—one that isn't subject to depletion or the whims of the market. But how do you know how much you'll receive

Matching search results: Dec 26, 2022 · How Much Can I Get From Social Security? ; $1,827 · $2,972 · $3,520 · $1,704.Dec 26, 2022 · How Much Can I Get From Social Security? ; $1,827 · $2,972 · $3,520 · $1,704. ...

Top 18: Understanding Social Security Benefits | The Motley FoolAuthor: fool.com - 104 Rating

Description: How Social Security works. Related Retirement Topics. Brief history of Social Security. Eligible family members include: Social Security forms an important part of most people's retirement plans, but the program itself does much more than just that. In a nutshell, Social Security is designed to support disabled and retired workers and their families by providing a guaranteed source of lifetime income for those who meet certain criteria.Here's a closer look at how the program works,. the differen

Matching search results: A worker typically must earn 40 credits to qualify for Social Security, though if they die or are disabled young, they may qualify with fewer credits. A credit ...A worker typically must earn 40 credits to qualify for Social Security, though if they die or are disabled young, they may qualify with fewer credits. A credit ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 nguoilontuoi Inc.